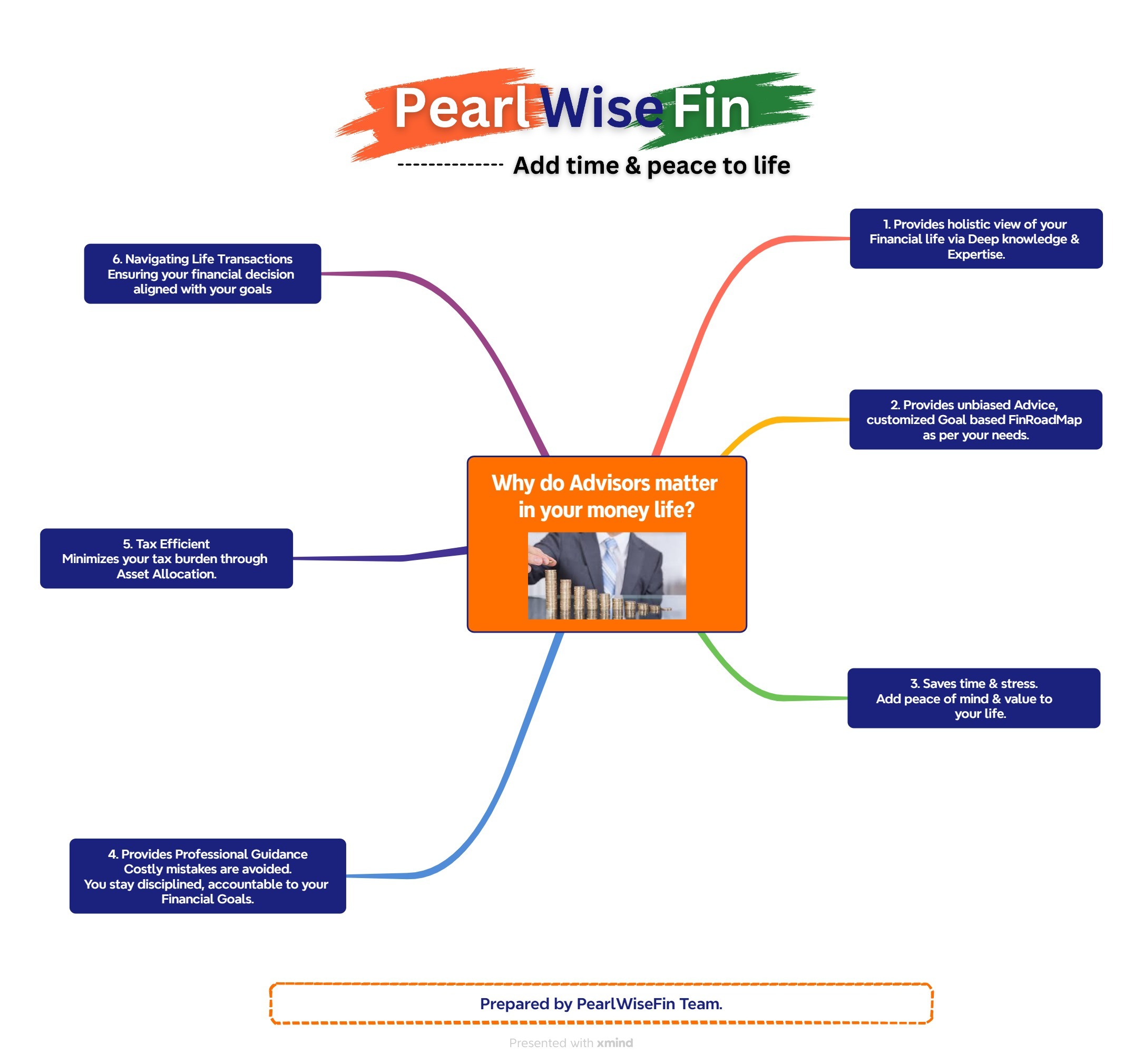

Why do advisors matter in your Money Life?

- Provides Holistic view of your financial life via Deep Knowledge and Expertise.

A financial advisor considers all aspects of your financial life—your income, expenses, investments, insurance, taxes, and more—and ensures they work together cohesively. This integrated approach helps you achieve long-term financial success by optimizing resources across different areas.

Financial advisors bring deep knowledge of various aspects of personal finance, including investment strategies, taxes, estate planning, retirement planning, and insurance. Their expertise helps you make informed decisions that can enhance your financial well-being and minimize mistakes.

- Provide Unbiased Advice, Customized goal-based Fin Roadmap as per your needs.

A financial advisor offers an unbiased perspective, helping you make decisions based on facts and data rather than emotions. When it comes to managing your money, it’s easy to get caught up in emotions like fear or greed, but advisors help you remain rational, especially during market volatility or personal financial stress.

Financial advisors create personalized strategies tailored to your unique financial situation, goals, and risk tolerance. Whether you’re saving for retirement, buying a home, or managing debt, they will help you create a plan that aligns with your specific needs.

Advisors help identify financial risks and suggest strategies to mitigate them. This includes diversifying investments, choosing the right insurance coverage, and advising on ways to protect against market downturns or unexpected financial challenges.

- Save time & stress. Add Peace of mind & value to your life.

Managing finances can be time-consuming and stressful, especially if you’re not well-versed in financial matters. A financial advisor takes on the responsibility of planning, investing, and monitoring your finances, allowing you to focus on other aspects of your life.

Having a financial advisor in your corner provides peace of mind, knowing that you have an expert managing your financial health and guiding you toward your goals. This sense of security is invaluable, particularly when facing complex financial decisions.

- Professional Guidance, Costly Mistakes are avoided.

Without professional guidance, it’s easy to make costly mistakes, whether it’s investing too aggressively, neglecting insurance, or failing to plan for taxes. Advisors help you avoid these errors by providing the necessary expertise and a proactive approach to your finances.

A financial advisor helps you stay disciplined and accountable to your financial goals. They monitor your progress and adjust your strategy as needed to keep you on track, helping you avoid impulsive decisions that could derail your financial future.

- Tax Efficiency

Financial advisors help you optimize your tax situation, ensuring that your investments, retirement accounts, and income sources are structured in a way that minimizes your tax burden. This can result in significant savings over time and improve your overall financial position.

- Navigating Life Transitions

Major life changes—like getting married, starting a family, changing careers, or inheriting assets—can complicate your financial situation. Financial advisors guide you through these transitions, ensuring your financial decisions remain aligned with your goals during periods of change.

Your advisor role is to hand hold with you to create multi-generational wealth, save you from Media & surroundings which make you Greedy or Panic.

Note: An advisor responsibility is not to forecast the economy & do short term market predictions.

In summary, financial advisors matter in your money life because they provide the knowledge, strategy, and support you need to navigate the complexities of personal finance, stay on track with your goals, and ultimately build a secure financial future.

Wishing you all a healthy financial life always.

PearlWiseFin Team.